How to Increase Transfer Limit on Union Bank Mobile App

Just like other commercial banks in Nigeria, Union Bank also has the maximum amount of money a user can transfer in a day. The transfer limit on Union Bank online banking or Mobile App is N250,000 daily. However, you can increase this limit now to N5,000,000 (five million Naira daily). Just log on to Uniononline and click on self-service. How to Increase Transfer Limit on Union Bank Mobile App.

Hello readers, welcome to my page. Today, we are doing Banking Mobile App and Online Banking. It is about how to increase the transfer limit on your bank without the help of bank staff. I mean, when you can’t go to the bank, you can do it anywhere and anytime.

In our previous posts, we have written on how to increase transfer limits on different banks. See all the banks we have written on how to increase the transfer limit:

- HOW TO INCREASE TRANSFER LIMIT ON GTB MOBILE BANK APP

- HOW TO INCREASE TRANSFER LIMIT ON UBA MOBILE BANK APP

- HOW TO INCREASE TRANSFER LIMIT ON ZENITH MOBILE BANK APP

So, here, we are going to time to give a step-by-step guide that will help Union Bank users tackle their transfer limit problem. If you are reading our article for the first time chill and continue reading because we don’t disappoint our readers. Remember to share our post and SUBSCRIBE to our Notification.

Before going into how to increase the transfer limit on union bank, there are other things you suppose to know. We assumed that you might be battling with some of those things, so we also decided to cover it here.

How to Increase Transfer Limit on Union Bank Mobile App

Union Bank USSD ShortCodes you should Know

These are the shortcodes you can use to carry out transactions on Union Bank with your phone. It is known as shortcut.

-

How to Check account balance

Dial *826*4# and press send.

- How to buy a recharge card on Union bank for yourself (Airtime purchase): *826*Amount#

- How to buy a recharge card on Union bank for another person (third party) – Airtime purchase: *826*Amount*3rd party mobile No and press #.

- How to make Transfers to Union Bank account: Dial *826*1*Amount*Account No and press #

- Transfers to Non-UBN bank accounts *826*2*Amount*Account no#

- Bills payment *826*28*amount*userID#

- Data capture after enrolment *826*3*account no#

- Card management (block and unblock card) *826*21#

- Cardless withdrawal *826*7*amount#

- How to Limit increase *826*8#

- Data purchase *826*9*amount#

- Mcash *826*22*merchantcode*amount#

What is Union bank Online Banking?

Union online banking was introduced to provide convenient transactions with your mobile phone or laptop. You can agree with me that going to the bank to withdraw or sending money every day is quite stressful but with Union bank online banking you will be provided with a 24/7 safe and convenient banking system from anywhere you are.

Features Of Union bank Online Banking

- Union Bank online banking provides easy access to your money on any smart device that has an internet connection.

- It is fast and convenient and risk-free. Am sure you will prefer sending money from your home to going to the bank to queue up to do transfers.

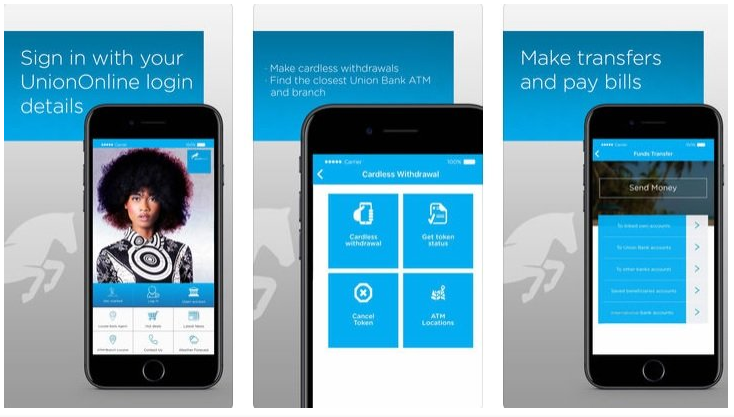

Union Bank Mobile App

Union Bank mobile app is the key too to union bank online banking so it’s important you know how to download and set it up.

How To Download and Install Union bank Mobile App

Step 1- Simple the go to play store or AppStore and download the app. The store you would download from depends on the device you are using

Step 2- After installation, launch the app on your device

Step 3- Click on new user and type in the required. Bear in mind that the number you will use for the registration is the one that is connected to your bank account.

How to register for union bank online banking

There are two ways to register, you can either register by visiting one of their branches or by doing it yourself

Here is how to do it by yourself;

step 1- Log onto the union bank website using the link>> www.unionbankng.com

Step 2- Navigate and click on “Internet Banking”

step 3- Click ” Not Enrolled? Sign up now!”

Step 4 – Type in your account number and press continue

Step 5- A pin will be sent to the number you used in opening your account. Enter it and proceed.

Step 6- Type in your desired password, confirm it and click on “submit”

Step 7- you can now log in with your username and the password you created.

Now, you are done with registration. But you can’t perform transactions yet because your account is not yet ready! To properly activate your account in other to start performing transactions here are the three things you need:

- A transfer right

- A token( Hardware, soft token, or SMS token

- A security word

To get a transfer right and a token you can visit any Union Bank branch near you and request it. Ask them at the customers’ service, they will put you through.

How to Increase Transfer Limit on Union Bank Mobile App

How to activate the soft token

If you have gotten your soft token, here is a simple way to activate it;

1. Download and install the soft token from the play store

2. Launch the app Press ” Enter activation data”

3. Type in the token serial number and activation code received in the number you used in opening your account

4. Create a password and submit.

How To Activate the hard token

1. Visit >>Uniononline

2. Go to settings and click on activate token

3. Type in the token serial number then click on the button to generate token code

4. Type in the token code then press on submit

How To Create The Security word (password)

1. Log onto Uniononline and navigate to settings

2. Type in a new security word and confirm it

3. Then type in Token or OTP.

Transfer Limit On Union Bank

What is the transfer limit a customer can make on Union Bank Online Banking or Mobile? By this question, we mean the maximum amount you can transfer with your phone via online from Union bank.

Just like other banks, union bank also has the maximum amount of money a user can transfer in a day. The transfer limit on union bank online banking is N250,000 daily.

How to increase transfer limit on union bank online banking

This has been a problem for many union bank users that is why we decided to solve it in this article. To increase your transaction limit the following step;

-

- Visit UnionOnline.

- After logging in (if requested) navigate and click on self-service.

- Click on manage transfer limits.

- Click on edit and type in your desired amount. Please note that the maximum amount you can input is N5,000,000.

- Input your security word and also your token code.

- Press submit and your limit will be successfully updated.

Meanwhile, #5,000,000 is not the maximum amount of money you can transfer from Union Bank in a day. You can actually exceed this limit.

However, it can’t be done by you. If you want to increase above N5,000,000 visit any union bank branch near you.

Thanks for reading. I hope this goes a long way in helping you solve your problem. In case of any confusion, you can contact union bank on their social media pages. If you found this article useful, don’t forget to like and share it.