How to Increase Transfer Limit on UBA Mobile App

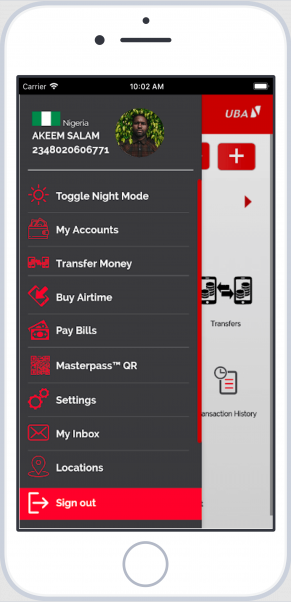

The maximum transfer limit on UBA mobile app is two hundred thousand (200,000) and it can be increased to a maximum of 5 million nairas only. How to increase the transfer limit on your UBA Mobile App to more than #200, 000, “Kindly click on the menu dropdown on the top left corner when you click to open the UBA App on your Phone and select banking services. Next, select the transaction limit and follow the prompt to increase your limit. A Secure Pass will be required for this”.

This method is known as “using the self-service option”. There are also other ways to increase the transfer limit. Continue reading for more details.

If you have ever thought about increasing your UBA transfer limit on a mobile app but didn’t know how to do it, this is a complete guide on how to do it. Previously we wrote on how to increase the transfer limit on GTB bank but in this particular article, we will be going in a different direction

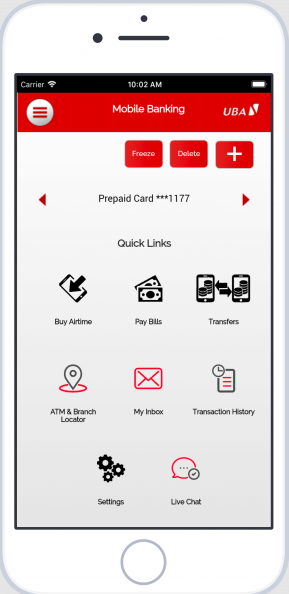

UBA Mobile App

United Bank for Africa(UBA) is a reputable bank that is known for its effective customer care service. They always find a way to upgrade their services so as to provide an easy and safe banking system for their customers.

On their mission to provide easy banking for their customers, they launched the UBA Mobile App. The app makes it easy for you to carry out transactions with either your mobile phone or laptop. The app was launched after CBN (Central Bank Of Nigeria) introduced the cashless policy. To support their movement, they allowed the use of banking apps and USSD codes.

How To Download and Set Up UBA App

To Use UBA Mobile App, you must have the following;

1. You must have a UBA account

2. The mobile number and email you used in opening your UBA account must be in use

3. An internet-connected device is needed. Be it Andriod or IOS

4. Your UBA ATM card is required.

How To Register on UBA mobile App

To start enjoying services like purchasing of airtime, DStv and GoTv subscription, online purchase, etc kindly follow the step by step guide below;

1. Download and Install UBA App from play store or Apple store

2. You have to choose between registering with your account or a debit card

3. You will now be asked to read and accept the terms and conditions after which you will be required to decide how you want your account to be registered. You can either select prepaid Card or register with account Number

4. An OTP(One Time Pin) will be sent on the number you used to open your account.

How To Get UBA Secure Pass

A secure pass is a software token. It is part of the mobile app. You can head over to the play store or apple store to download the UBA secure pass application. After successful installation, follow the below process;

1. Navigate, then input your UBA mobile banking ID

2. Select your country then click on ok

3. An OTP code will be sent to your phone, enter the code and click on ok

4. “Select ” I Will like to request a Secure pass”

5. answer the required security question if at all there is any

6. Name your token identity and click on OK

7.Click on “Activate UBA Secure Pass when asked to secure pass identity

8. Click on “Next” and proceed

9. Input a new 4 digit code and click on “Submit to get your first token

10. The code will expire after some time, so all you need do is to log into the app any time you need to use the secure pass to have a new OTP code generated.

Now we are done with setting up your UBA mobile app, lets now dive into the main purpose of this article

How To Increase Transfer Limit On UBA Mobile App

Increasing transfer limit has been a popular keyword that is the reason 9jainformed decided to write on it so as to help users sought out the issue

Know this, 9jainformed will do anything to see that we help you sought out your problem. To keep our promise to provide solutions to some of your problems, we contacted UBA customer care on their Facebook page so as to get an accurate and more direct answer to your question. Here is that reply we got;

“Hello, please be notified that you can increase your limit on the UBA Mobile Application by using our self-service option. Kindly click on the menu dropdown on the top left corner and select banking services. Next, select the transaction limit and follow the prompt to increase your limit. A Secure Pass will be required for this.

There are two types of secure pass: Hard secure pass (Hard token) – To obtain the Hard secure pass, please be advised to visit any of our Business Offices to get this at a cost of N2,500.00 only.

The other is the Soft secure pass (U-token). To get the Soft Secure Pass, please be advised to download our Secure Pass (U-token), visit your application store (Google Play-store, app world, or apple store) on the Android, Blackberry 10, and iPhone respectively, then search for UBA Secure Pass (red background and white logo). Download and install on your mobile device. Please contact us to assist with the enrollment process.

Thank you.”

Reasons or Why Do you Need to Increase Transfer Limit

There are so many reasons why bank customers set their mobile app bank transfers on a certain limit. There are also reasons why this limit will need to be increased. They are:

-

For Security

Mobile banking users opt for certain transfer reasons for the safety of their money. The reason is that if their cards or phones are stolen, the thief will not withdraw or exceed the set limit.

-

For Emergency Business Transaction

Bank customers now have the need to increase their transfer limit when they have emergency business transactions and when they cannot go to the bank for it.

For instance, you may have an online business transaction during the weekend or holiday. The only option is to increase your transfer limit on your banking mobile app self-service and carry out the business transaction.

-

When you cannot Access Direct services from your Bank

Originally, everything banking was done inside the banking hall for the customers by the bankers. However, as technology begins to advance, companies sought means to help their clients with self-service.

So, the essence of introducing a Banking App by UBA and other Banks is to help customers to be able to access banking services at home without having to come to the bank always. When you cannot access your bank directly to increase your transfer limit, you can do it through the mobile app.

Frequently asked questions on How To Increase Transfer LImit On UBA APP

-

What is the UBA Transfer Limit On Mobile App?

The maximum transfer limit on UBA mobile app is two hundred thousand (200,000) and can be increased to a maximum of 5 million nairas only.

-

Question: Why is my UBA App not working?

Answer: This might be due to a network issue. Try logging out and logging in again.

-

Question: How can I enroll in UBA internet banking?

Answer: This can be done in many ways:

Instant Self-Registration- Individual clients can start and conclude registration using their debit card via our Internet Banking login page, ibank.ubagroup.com, by clicking the Instant Self-Registration option. This process usually takes around 40 seconds to finish!

Enrollment with Virtual Enrollment Form -Individuals and businesses can also use the interactive online PDF forms to enroll. The following is a link to the forms: U-Direct Virtual Channel Enrollment Form – Individual Internet Banking U-Direct Virtual Channel Enrollment Form – Corporate Internet Banking

Enrollment through our Business Offices -You may enroll in Internet Banking by walking into any of our Business Offices and filling out a form. Corporate customers may also direct RMs or Business Offices to enroll their preferred users on their letterhead – there is no limit to how many users can be enrolled under a corporate user.

-

Question: How to get UBA token and how much does getting a token cost?

Answer: If you want a hard token, you may get one for 2,500 Naira at any UBA Business Office. U-Token is accessible for free in-app stores for download and fast activation for your transactions, giving you greater freedom.

Summary on How to Increase Transfer Limit on UBA Mobile App

I hope this goes a long way in solving your problem. For more questions, you can contact UBA on either their Facebook or Twitter page for more clarification. Thanks for reading and don’t forget to share if the article was helpful to you.